Is generally depreciated over a recovery period of 27 5 years using the straight line method of depreciation and a mid month convention as residential rental property.

Which depreciation method is used for new roof.

This just seems low to me.

She spent 10 000 to replace the roof this year.

1 your basis in the property 2 the recovery period for the property and 3 the depreciation method used.

The roof cost 5482 but after putting all the information in it only depreciated 42 for 27 5 years.

Since the roof is newer than the structure itself the roof will technically lose its value after the building.

We replaced the roof with all new materials replaced all the gutters replaced all the windows and doors replaced the furnace and painted the property s exteriors.

I own a condo that i rent out.

The irs states that a new roof will depreciate over the course of 27 5 years for residential buildings and over the course of 39 years for commercial buildings.

The replacement cost of the roof and the expected lifetime of the roof for example the average cost to replace a roof is 10 000 and asphalt roofs generally have a lifespan of 15 years.

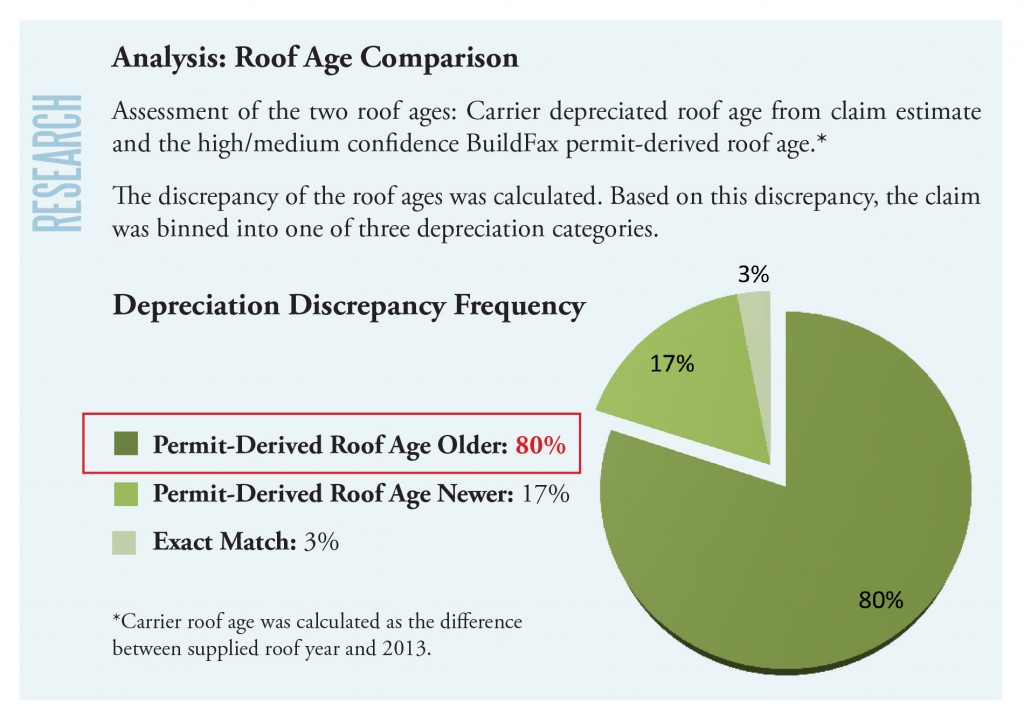

The cpi has risen by 24 7 over the last 10 years so the old roof s placed in service year cost is valued at 7 530.

Calculating depreciation begins with two factors.

At the end of last year the roof for the entire building was replaced.

Alice elects to use the cpi index method to determine the basis of the old roof which was placed in service ten years ago.

Straight line depreciation is the most straightforward method for calculating a new roof s depreciation.

Using any other reasonable method.

Improvements are depreciated using the straight line method which means that you must deduct the same amount every year over the useful life of the roof.

First collect your receipts and calculate the total cost of the new roof.

Any comments if it could be correct.

Three factors determine how much depreciation you can deduct each year.

From what i ve read about this special depreciation allowance it doesn t seem like i should be able to instead i should have to depreciate it over.

Macrs convention was mm any help would be appreciated.

This is because before a business could only make a tax claim on these installations after they slowly depreciated over 39 years.

You can t simply deduct your mortgage or principal payments or the cost of furniture fixtures and equipment as an expense.

The depreciation is the same for each year of the roof s useful life.

However under the old laws this would be rather difficult.

The best course of action that you could take at this point would be to invest in a brand new state of the art system.

Once you know the start date calculating the depreciation is reasonably straightforward.

Once the roof is in place it begins to lose its value.